How to start an LLC in Texas

- Sierra Johnson

- Feb 8, 2022

- 5 min read

What is an LLC?

An LLC is a type of business structure that has been given certain legal benefits. LLC stands for Limited Liability Company, which means that when a person follows certain rules for running their LLC that their personal assets are shielded from their business assets. LLC’s are some of the most flexible business structures as they can be created to do lots of creative things inside of operating agreements.

Who Needs and LLC & Why?

There are several reasons that someone would want to start an LLC, the main one is if they want to shield their personal assets from their business assets. If you have an LLC and some type of lawsuit is brought against it, then the business owner’s personal assets are insulated from the suit. Common examples of this are companies where physical proximity to the client is required, anything from a nail salon to a construction business could have some type of potential lawsuit happen where the owner would want their personal assets shielded.

There are businesses that don’t have any type of personal proximity or inherent risk, but would still want to use an LLC because it is a flexible way to create specific rules about how your company is run and creates an outlet for potential tax savings over a DBA.

Getting Started:

Choosing a name/checking for availability

The first step in starting an LLC in Texas is to make sure the name you want isn’t already taken. The State of Texas only allows one business entity per name.

There are two main ways to see if your name is available they both cost $1.00.

1. Make a phone inquiry to the Texas Secretary of State at (512) 463-5555.

2. Electronically via - Texas SOS Direct

Setting up Texas SOS Direct

Fill out Form

Verify your email and you've successfully setup your Texas SOS Direct account!

Electronic Name Availability Search

Login to your account using the information you just setup. https://direct.sos.state.tx.us/acct/acct-login.asp

You’ll be greeted with this screen. Go ahead and fill out the required information and select Continue.

Fill out your credit card information and select continue.

Select Business Organizations at the top.

Then select Name Availability Search.

Put in the name you’d like to check on.

Review the results to see if a business with that name exists and says “Active” if it does then use a different name, but if not you’re good to go!

**If you have questions regarding whether a name is available please use the phone number provided above to reach out to the Texas SOS, or find a good CPA/Attorney to review - if you file an application with a name that is already taken you will not be refunded or approved**

Filing for LLC

Once you’ve picked a name and confirmed it is available, the next step is to decide how you will file.

If you setup an Texas SOS Direct account and did your name search in it, then the electronic option is your fastest/easiest method.

A. By Mail – 1-2 week turnaround time

B. Electronically - ~4 day turnaround time

By Mail

To do it by mail you need to fill out the Certificate of Formation, available here. You’re looking for form number 205.

**If at any time you need help or would like a guide, the Texas SOS has provided the following: https://direct.sos.state.tx.us/help/help-corp-filing-205.html **

Article 1 – Entity Name and Type

This is where you put in the name that you found earlier. Must include “limited liability company,” “limited company,” or “LLC.”

Article 2 – Registered Agent and Registered Office

A registered agent is someone who can be served in the event of a lawsuit and who will show up on the SOS records as the agent. They normally don’t have any additional power than that – oftentimes an attorney will be the registered agent. There are also registered agent services where you can pay ~$20 or so per year to have a registered agent and address. This is predominately used because owners may not want to post their personal addresses.

A. – Select this if you want a separate LLC or business you have to own the LLC

B. – Used if you want to be the registered agent as an individual

C. – The business address for the office of the registered agent

Article 3 – Governing Authority

A. – Managers

B. – No managers, just members

The default LLC system is member managed, meaning each person is an owner and has equal rights to make changes, etc. A manager system designates specific people who are not only owners but who have authority over the day to day workings of the business. As discussed above it is highly recommended that you start a single member LLC and not a multi-member LLC as you’ll need to have a more specific operating agreement for the multi-member LLC and for that you should get help of a qualified CPA or Attorney.

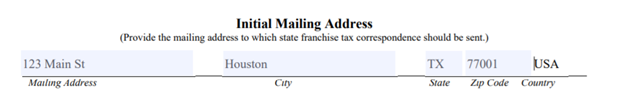

Initial Mailing Address

Fill out the mailing address for state franchise tax and other information.

Supplemental Provisions/Information

Nothing needs to be here for a basic LLC.

Organizer

Just input your information again.

Effectiveness of Filing

Typically you want to choose A, unless you want the LLC to come into existence at a later date.

Execution

Sign and date.

Submitting the form/Costs

Mail it in –

Print out your application minus the instruction pages at the beginning, put in a $300 check addressed to Texas Secretary of State, and mail to:

Business & Commercial Section

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Wait 1-2 weeks for the Secretary of State to process the paperwork.

Success! You have an LLC!

Electronically

Log back into SOS Direct at https://direct.sos.state.tx.us/acct/acct-login.asp, and follow the instructions from before. It will likely ask you to verify your contact information and your credit card info again, then click on Business Organizations at the top.

Last time we clicked Name Availability Search, but this time we want to select “Domestic Limited Liability Company (LLC) from the Reservation/Formation/Registration Documents section.

Next select Certification of Formation from the Filing Type drop down.

Input the name of the company and make sure Limited Liability Company is selected again.

The SOS is putting a disclaimer here that your name may not be available even if you think it is and gives you another option to do the name availability search.

Put in the initial mailing address that will be used.

Put in the Registered Agent information and address.

Select whether you want your LLC to be manager or member managed.

Put in the information for the organizer (typically just your own information).

E-Sign the form and press continue.

Finally, review your Certificate of Formation for any errors, once everything looks fine press "Submit Filing" which will submit the form and pay $300 from the credit card you put on file.

Wait ~4 days for receipt and processing of your LLC request.

Success! You've officially filed as an LLC!

Comments